Jan 01, 2024

5

5

PAYING RESALE TAX

Policy

- City resale tax payments are done quarterly. Below are the deadlines:

- Q1= April 20th

- Q2= July 20th

- Q3= Oct 20th

- Q4= Jan 20th

- State and County tax payments are due monthly by the 15th.

Task

When a resale tax payment is due, the Bookkeeper:

-

- Navigates to appropriate Quickbooks file

-

- Opens Sales Tax Calculator google doc

-

- Calculates “Non-taxable Sales” in google doc

-

-

- Navigates to “reports” from left hand toolbar

- Under Profit and Loss, clicks “Run”

- Sets appropriate “Report Period”

- Clicks “Run Report”

- Enters “Service Revenue” from P&L onto google doc

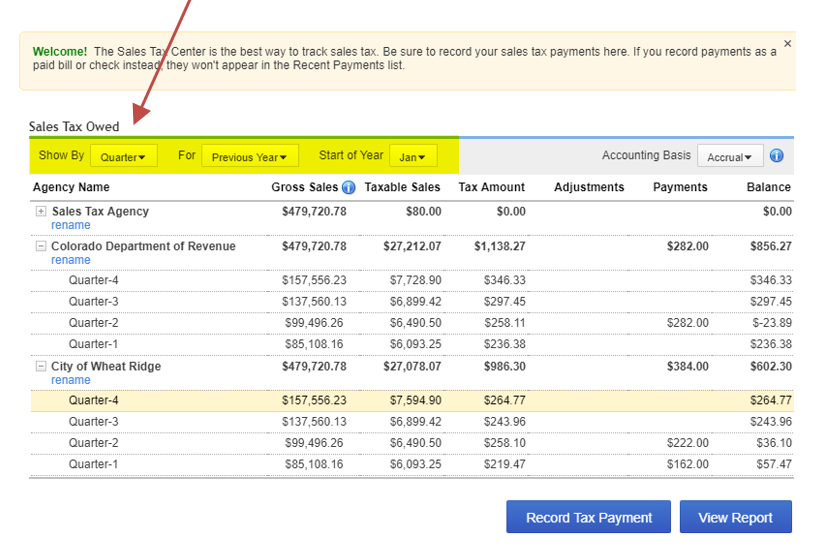

- Opens “Taxes” from left hand toolbar

- Clicks “+” sign next to City of Wheat Ridge and Colorado Dept of Revenue to expand the selection

- Sets appropriate “show by”, “for and “start of year”

-

-

-

- Enters “Gross sales” from QBO Tax Center into google doc

- Enters “Taxable Sales” from QBO Tax Center into google doc

-

-

- Navigates to Last Pass to begin filing tax payments online

-

- Files CITY sales tax payment

-

-

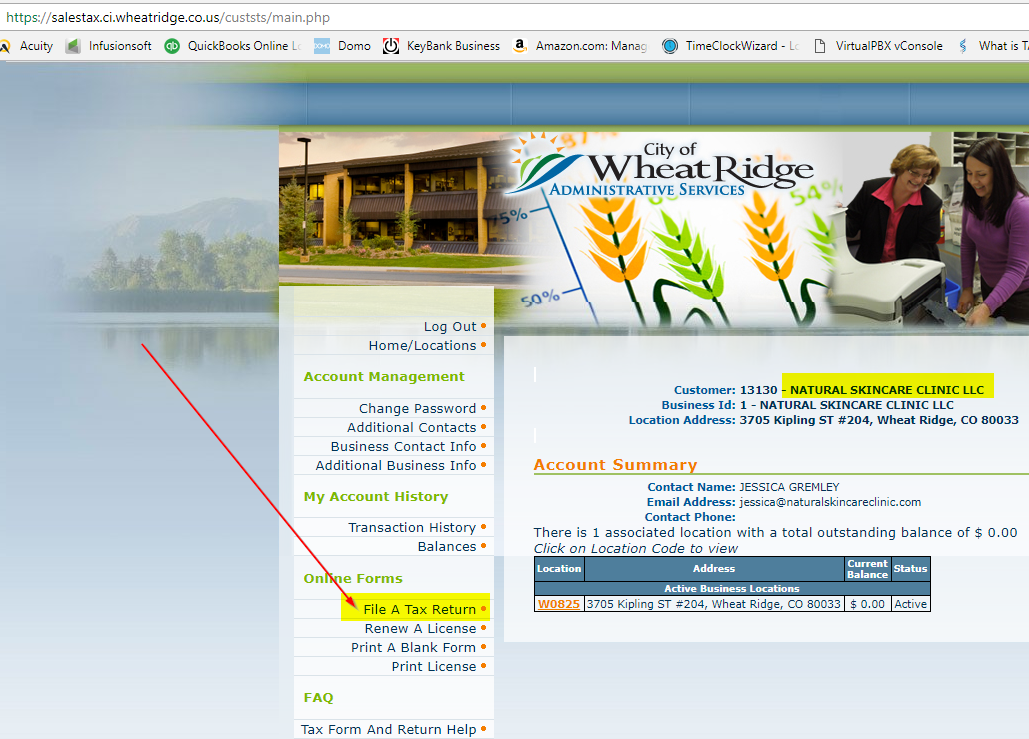

- Searches and Launches: “NSC Sales Tax- Wheat Ridge”

- Confirms the Business ID is the appropriate company

- In the City of Wheat Ridge Sales Tax Portal, clicks “File a Tax Return”

-

-

-

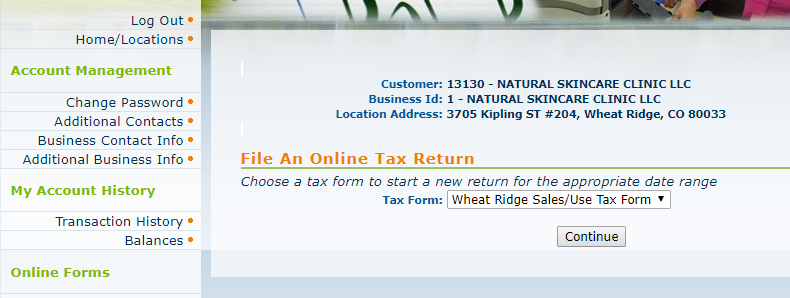

- Clicks “Continue” on the below screen

-

-

-

- Enters filing period date and clicks continue

- Enters below data into the form from the Google Doc:

- Gross Sales & Service

- Non-taxable Service Sales

- Sales Shipped Out of City of State

- Confirms Line 4 of the Form equals the “Taxable Sales” on the google doc (if it is within $20 it is ok)

- Clicks “Save Form”

- Selects “Make Payment Online with a Credit Card”

- Accepts Terms and Conditions

- Enters appropriate credit card and billing address

- Prints receipts

-

-

- Files State (and county) tax payment

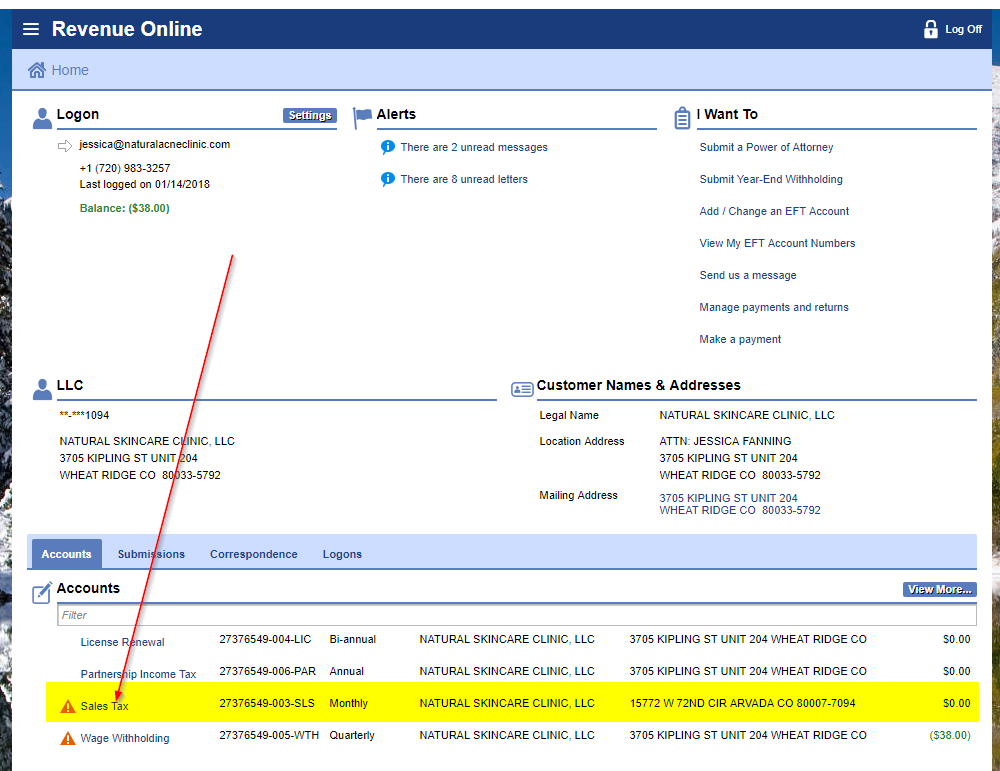

- Searches and Launches in Last Pass: “NSC Sales Tax State of CO”

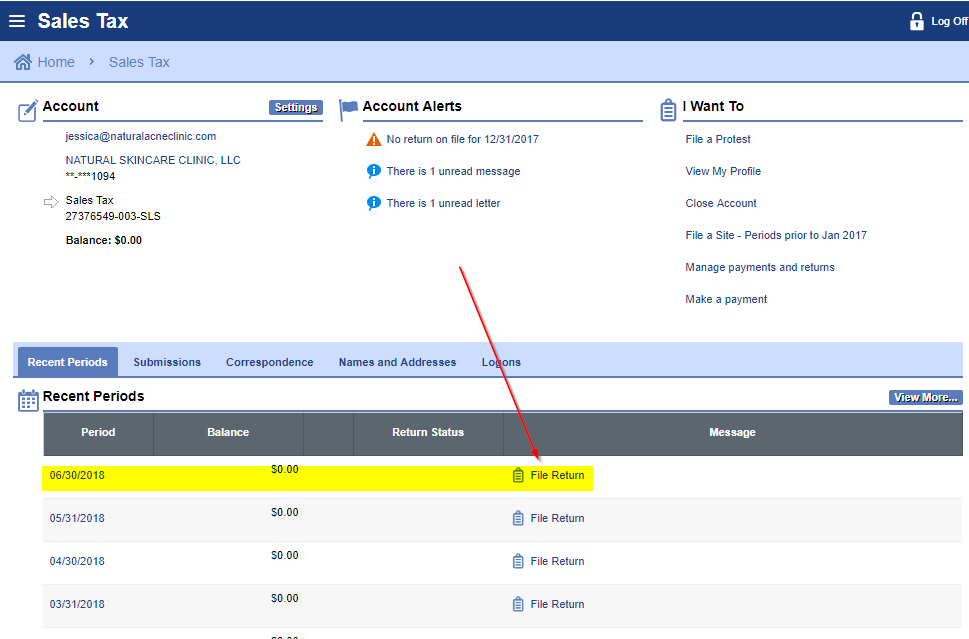

- In the Colorado Revenue On-line website, clicks “Sales Tax” link under Accounts

- Files State (and county) tax payment

-

-

- Under Recent Periods, selects “File Return”

-

-

-

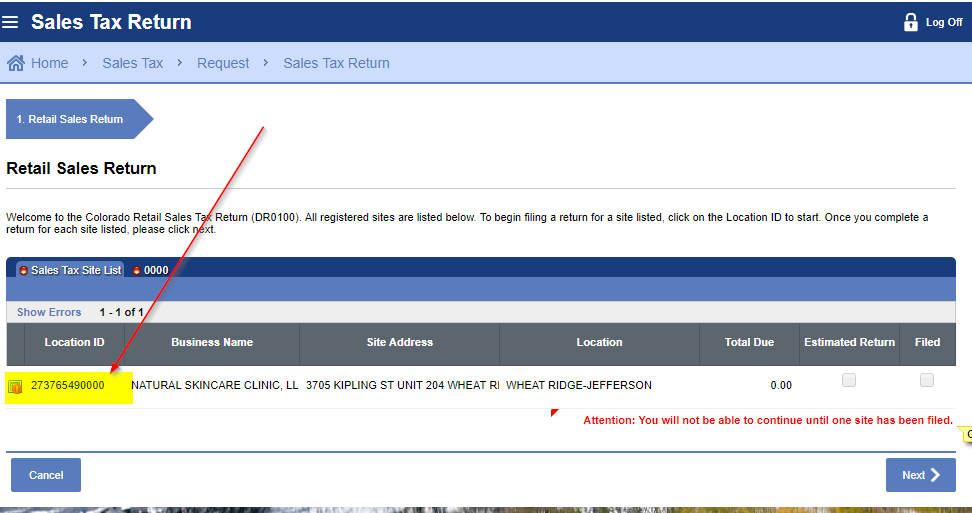

- Clicks “File Retail Sales Tax Return”

- Clicks on “Location ID”

-

-

-

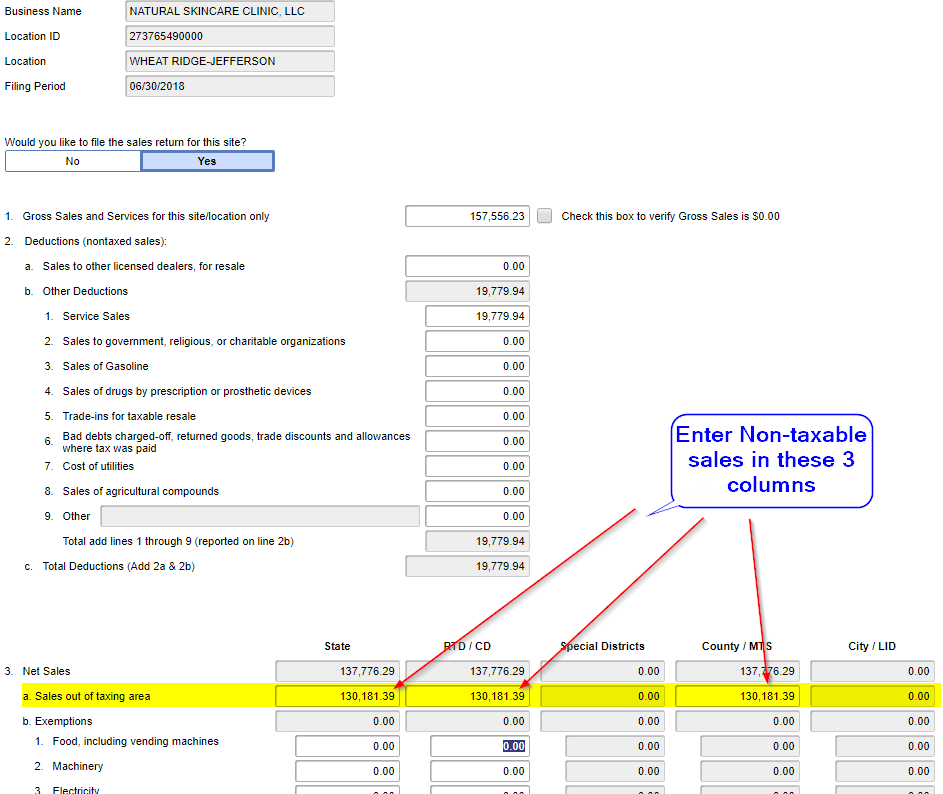

- Enters below data into the form from the Google Doc:

- Gross Sales & Service

- Service Sales (2.b.1)

- Sales Out of Taxing Area under State, RTD/CD and County/MTS columns. See screenshot below.

- Enters below data into the form from the Google Doc:

-

-

-

- Confirms Line 4 of the Form equals the “Taxable Sales” on the google doc (if it is within $20 it is ok)

- Confirms total tax owed and clicks Next

- Checks box indicating we do not pay Special District Sales Tax

- Checks box “I agree”

- Prints copy of tax return

- Makes payment (Refer TSK-XXX)

-